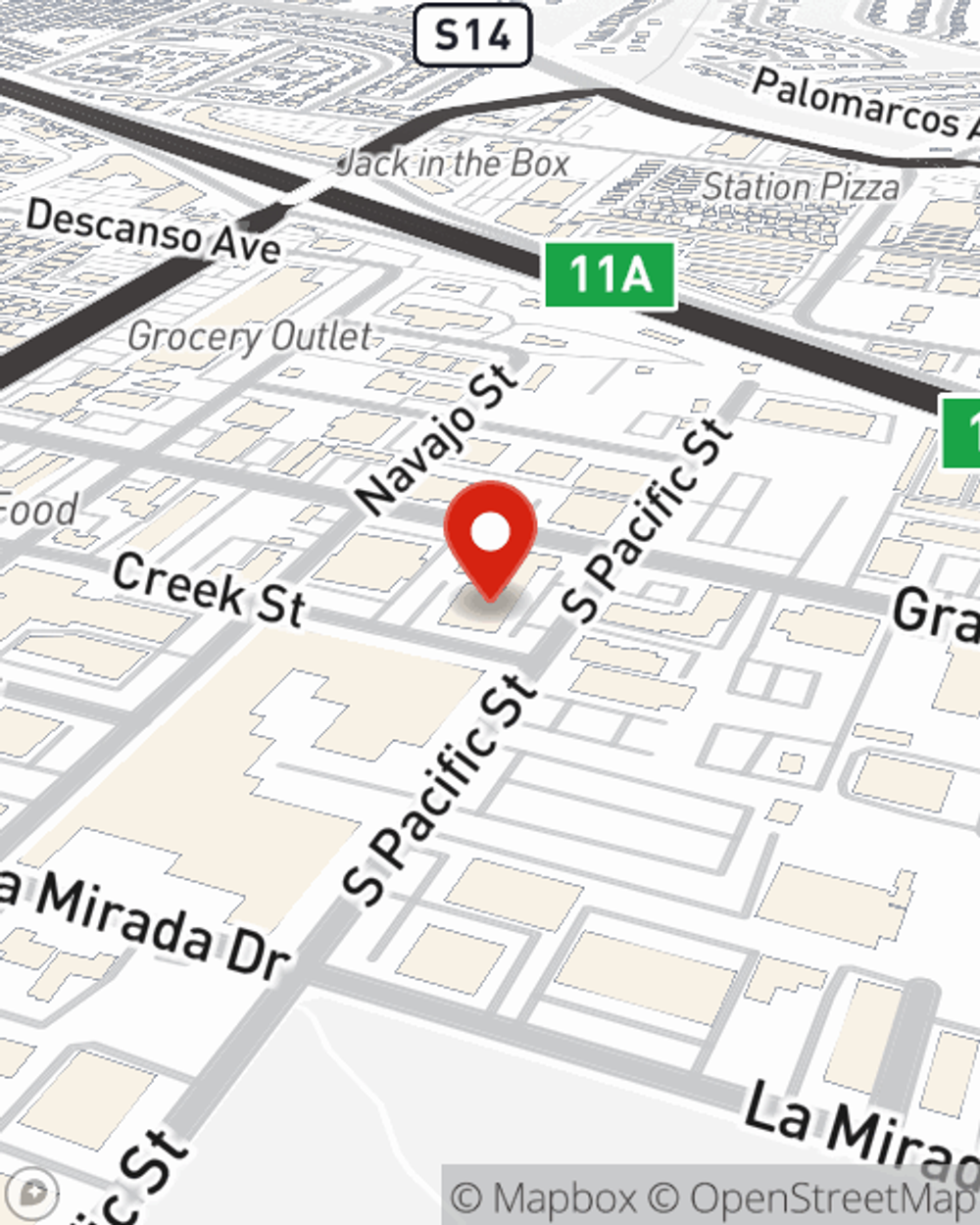

Renters Insurance in and around San Marcos

Welcome, home & apartment renters of San Marcos!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- San Diego

- Vista

- Carlsbad

- San Elijo Hills

- Phoenix

- Scottsdale

- Gilbert

- Arizona

- Nevada

- Oregon

- Oceanside

- Chandler

- Flagstaff

- Maricopa

- Buckeye

- Goodyear

- Enterprise

- Reno

- Clark County

- Spring Valley

- Las Vegas-Henderson

- Paradise

- Portland

- Lake Havasu

Home Is Where Your Heart Is

No matter what you're considering as you rent a home - location, utilities, outdoor living space, townhome or condo - getting the right insurance can be essential in the event of the unanticipated.

Welcome, home & apartment renters of San Marcos!

Renting a home? Insure what you own.

Agent Vladan Trifunovic, At Your Service

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm renters policy. Renters insurance protects the things inside your space with coverage. In the event of vandalism or a fire, some of your belongings might have damage. If you don't have enough coverage, you might not be able to replace your valuables. It's scary to think that in one moment, the unexpected could wipe out all you've invested in. Despite all that could go wrong, State Farm Agent Vladan Trifunovic is ready to help.Vladan Trifunovic can help offer options for the level of coverage you have in mind. You can even include protection for valuables beyond the walls of your home. For example, if a pipe suddenly bursts in the unit above you and damages your furniture, your bicycle is stolen from work or your car is stolen with your computer inside it, Agent Vladan Trifunovic can be there to help you submit your claim and help your life go right again.

It's never a bad idea to make sure you're prepared. Get in touch with State Farm agent Vladan Trifunovic for help getting started on savings options for your rented property.

Have More Questions About Renters Insurance?

Call Vladan at (760) 471-6111 or visit our FAQ page.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Vladan Trifunovic

State Farm® Insurance AgentSimple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.